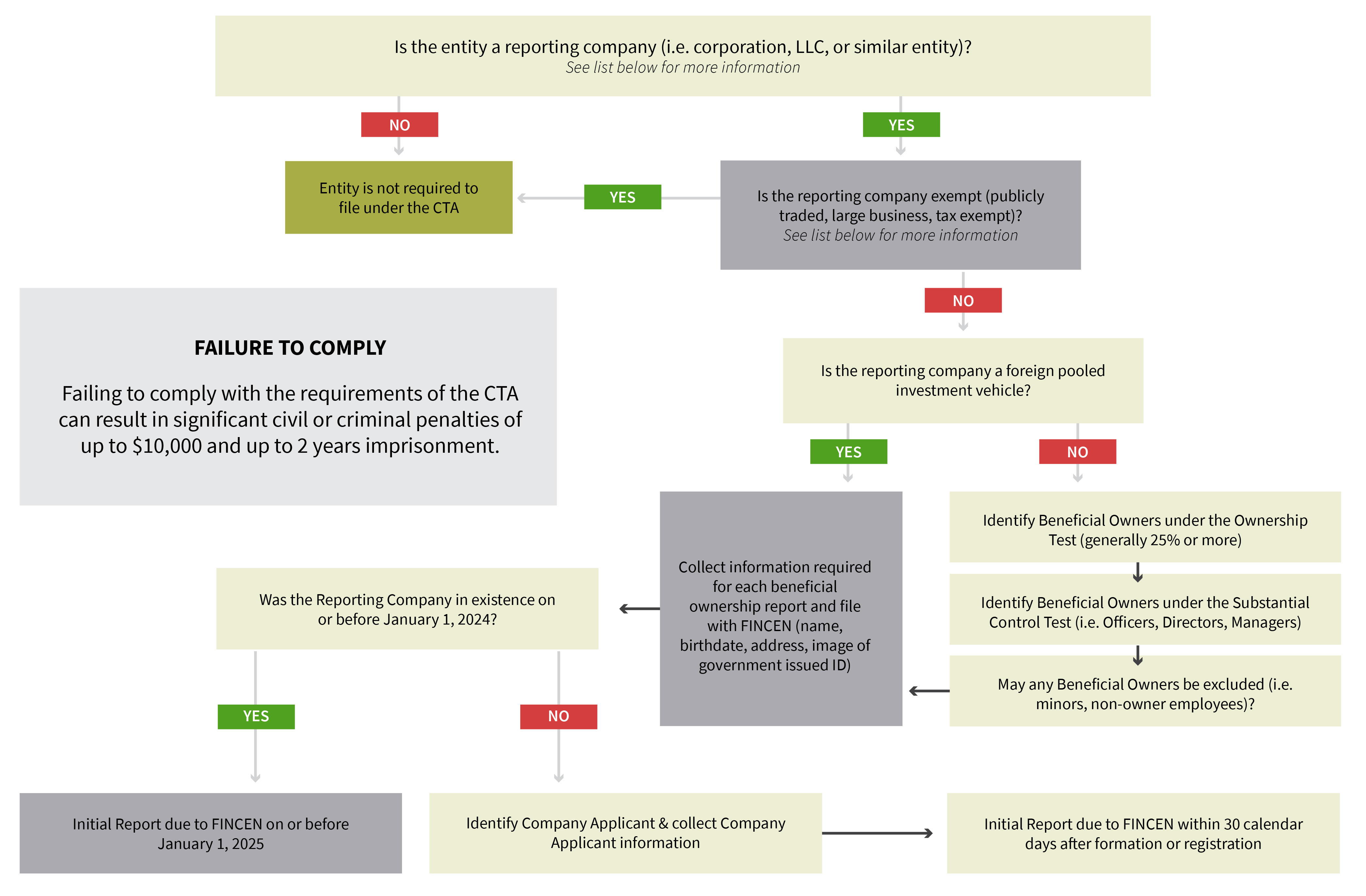

On January 1, 2024, the Corporate Transparency Act (the “CTA”) will take effect the CTA will impose significant new reporting requirements on most small businesses.

The CTA was enacted by Congress as part of its effort to combat terrorism, organized crime, and money-laundering. The CTA requires most entities (referred to as “reporting companies”) to report information about the companies themselves, their beneficial owners, and company applicants (the

persons who signed the formation documents for the entity). It is vital to understand that the law is quite broad and will apply to a vast number of companies, with severe penalties for not accurately and timely reporting required information to the government.